Key Market Insights

- The landscape of antibody drug conjugates has steadily evolved over the past decade; more than 530 antibody drug conjugates therapy programs are being evaluated by over 140 drug developers, worldwide

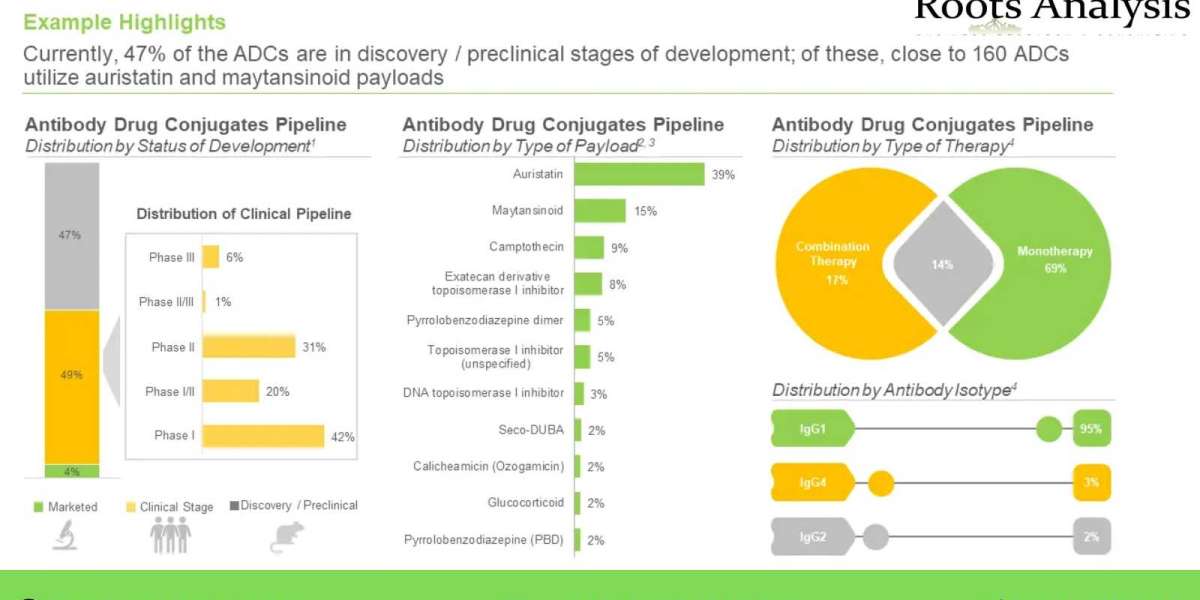

- Currently, 47% of the antibody drug conjugates (ADCs) are in discovery / preclinical stages of development; of these, close to 160 ADCs utilize auristatin and maytansinoid payloads to target a wide array of antigens

- In order to gain a competitive edge, antibody drug conjugate developers are actively conducting multiple clinical trials across different geographies to explore novel targets for the treatment of a wide array of indications

- Since 2010, over 565 clinical trials have been registered to evaluate the safety and efficacy of various antibody drug conjugates; majority of these studies have been conducted across various sites in the US

- Various developers have recently evaluated more than 190 antibody drug conjugates in combination with other therapeutic modalities for the treatment of various oncological disorders

- The growing interest of various stakeholders in this field is evident from the rise in partnership activity over the years; in fact, maximum partnerships were signed in 2022

- Considering the enormous opportunities associated with antibody drug conjugates for the treatment of cancer, several investors have extended funds, worth nearly USD 30 billion, in the last decade

- Several researchers from renowned universities, currently involved in evaluating efficacy and safety of antibody drug conjugates, have emerged as prominent KOLs

- Over the years, the intellectual capital related to the therapeutic applications of ADCs has grown at a commendable pace, with more than 3,330 patents being filed by both industry and non-industry players

- Grants worth over USD 135 million, disbursed across more than 245 instances, have been awarded for research activity related to antibody drug conjugates; nearly 90% of these grants extend a support period of up to 10 years

- Stakeholders are exploring diverse commercialization strategies across different stages of a drug’s launch cycle; for drugs nearing patent expiry, these developers are expected to adopt lifecycle management strategies

- With an objective to keep patients and healthcare professionals abreast with the developments, companies are deploying diverse promotional strategies for their respective products

- Presently, around 35 players, across the globe, claim to have the required capabilities to offer contract manufacturing / conjugation services for antibody drug conjugates; of these, over 10 players are one-stop-shops

- Our proprietary success protocol analysis highlights the impact of over 10 key factors that must be taken into consideration to determine the success of an antibody drug conjugate

- An exclusive cost price analysis offers comprehensive insights on the cost of individual components and likely price of antibody drug conjugates

- With 14 approved antibody drug conjugates and a promising developmental pipeline, the global antibody drug conjugates market is anticipated to witness an annualized growth of nearly 10% over the next decade

- The projected opportunity within this segment is expected to be well distributed across different target disease indication, therapeutic area and key geographical regions

Table of Contents

- PREFACE

1.1. Antibody Drug Conjugate Market Overview

1.2. Key Market Insights

1.3. Scope of the Report

1.4. Research Methodology

1.5. Key Questions Answered

1.6. Chapter Outlines

2. EXECUTIVE SUMMARY

INTRODUCTION

3.1. Chapter Overview

3.2. Pillars of Cancer Therapy

3.3. Overview of Antibody Drug Conjugates

- Concluding Remarks

- MARKET OVERVIEW

4.1. Chapter Overview

4.2. Antibody Drug Conjugates: Therapies Pipeline

4.3. Antibody Drug Conjugate: List of Therapy Developers

- TARGET COMPETITIVENESS ANALYSIS

5.1. Chapter Overview

5.2. Key Parameters

5.3. Methodology

5.4. Target Competitiveness Analysis: Key Targets of Antibody Drug Conjugates

- COMPANY AND DRUG PROFILES

6.1. Chapter Overview

6.2. ADC Therapeutics

6.2.1. Company Overview

6.2.2. Financial Information

6.2.3. Pipeline Overview

6.2.3.1. Zynlonta

6.2.4. Recent Developments and Future Outlook

6.3. Astellas Pharma

6.4. AstraZeneca

6.5. Byondis

6.6. Daiichi Sankyo

6.7. Genentech (Subsidiary of Roche)

6.8. Gilead Sciences

6.9. ImmunoGen

6.10. Pfizer

6.11. RemeGen

6.12. Seagen

- CLINICAL TRIAL ANALYSIS

7.1. Chapter Overview

7.2. Scope and Methodology

7.3. Antibody Drug Conjugates: Clinical Trial Analysis

- KEY OPINION LEADERS

8.1. Chapter Overview

8.2. Assumption and Key Parameters

8.3. Methodology

8.4. Antibody Drug Conjugates: Key Opinion Leaders

- COMBINATION THERAPIES

9.1. Chapter Overview

9.2. Combination Therapies: History of Development

9.3. Combination Therapies: FDA Guidelines

9.4. Combination Therapies: Antibody Drug Conjugates

- PARTNERSHIPS AND COLLABORATIONS

10.1. Chapter Overview

10.2. Partnership Models

10.3. Antibody Drug Conjugates: List of Partnerships and Collaborations

- FUNDING AND INVESTMENT ANALYSIS

11.1. Chapter Overview

11.2. Types of Funding

11.3. Antibody Drug Conjugates: List of Funding and Investment Analysis

- PATENT ANALYSIS

12.1. Chapter Overview

12.2. Scope and Methodology

12.3. Antibody Drug Conjugates: Patent Analysis

12.4. Antibody Drug Conjugate: Patent Benchmarking Analysis

12.5. Antibody Drug Conjugate: Patent Valuation

12.6. Leading Patents by Number of Citations

- ACADEMIC GRANTS ANALYSIS

13.1. Chapter Overview

13.2. Scope and Methodology

13.3. Antibody Drug Conjugates: Grants Analysis

- KEY COMMMERCIALIZATION STRATEGIES

14.1. Chapter Overview

14.2. Successful Drug Launch Strategy: ROOTS Framework

14.3. Successful Drug Launch Strategy: Product Differentiation

14.4. Common Commercialization Strategies Adopted Across Different Stages of Product Development

14.5. Key Commercialization Strategies Adopted by the Companies Focused on Antibody Drug Conjugates

14.6. Concluding Remarks

- PROMOTIONAL ANALYSIS

15.1. Chapter Overview

15.2. Channels Used for Promotional Campaigns

15.3. Summary of Product Website

15.4. Summary of Patient Support Services and Informative Downloads

15.5. Adcetris: Promotional Analysis

15.6. Besponsa: Promotional Analysis

15.7. Enhertu: Promotional Analysis

15.8. Kadcyla: Promotional Analysis

15.9. Mylotarg: Promotional Analysis

15.10. Polivy: Promotional Analysis

15.11. Trodelvy: Promotional Analysis

- SUCCESS PROTOCOL ANALYSIS

16.1. Chapter Overview

16.2. Antibody Drug Conjugates: Success Protocol Analysis

16.3. Adcetris (Seagen / Takeda Oncology)

16.4. Aidixi (RemeGen)

16.5. Akalux (Rakuten Medical)

16.6. Besponsa (Pfizer / UCB)

16.7. Blenrep (GlaxoSmithKline)

16.8. Elahere (ImmunoGen)

16.9. Enhertu (Daiichi Sankyo / AstraZeneca)

16.10. Kadcyla (Genentech / ImmunoGen)

16.11. Padcev (Seagen / Astellas Pharma)

16.12. Polivy (Genentech)

16.13. Tivdak (Seagen / Genmab)

16.14. Trodelvy (Gilead Sciences)

16.15. Zynlonta (ADC Therapeutics)

16.16. Concluding Remarks

- NOVEL CONJUGATION AND LINKER TECHNOLOGY PLATFORMS

17.1. Chapter Overview

17.2. Antibody Drug Conjugates: Conjugation Technologies

17.3. Antibody Drug Conjugates: List of Conjugation Technologies

17.4. Antibody Drug Conjugates: Linker Technologies

17.5. Antibody Drug Conjugates: List of Linker and Linker-Payload Technologies

17.6. Concluding Remarks

- ASSESSMENT OF NON-CLINICAL DATA FIRST IN HUMAN DOSING

18.1. Chapter Overview

18.2. Antibody Drug Conjugates: Non-Clinical Studies

18.3. ICH S9 Guidelines

18.4. Investigational New Drug (IND)-Enabling Study Designs

18.5. Toxicities in Animal Models

18.6. Prediction of Maximum Tolerated Dosage (MTD) in Humans

18.7. Other Key Considerations for Study Design

- COST PRICE ANALYSIS

19.1. Chapter Overview

19.2. Factors Contributing Towards the High Price of Antibody-Drug Conjugates

19.3. Antibody Drug Conjugates Market: Cost Price Analysis

19.4. Reimbursement Considerations for Antibody-Drug Conjugates

- CASE STUDY 1: CONTRACT MANUFACTURING OF ANTIBODY-DRUG CONJUGATES

20.1. Chapter Overview

20.2. Key Steps in Antibody Drug Conjugate Manufacturing Process

20.3. Technical Challenges Related to Antibody Drug Conjugate Manufacturing

20.4. Challenges Associated with Supply Chain and Method Transfer

20.5. Limitations of In-House Manufacturing

20.6. Investments in Antibody Drug Conjugate Manufacturing Capability Expansions

20.7. Collaborations Established for Antibody-Drug Conjugate Manufacturing

20.8. Growing Demand for Antibody-Drug Conjugate Contract Manufacturing

20.9. CMOs with Linker Manufacturing Capabilities

20.10. CMOs with HPAPI / Cytotoxic Payload Manufacturing Capabilities

20.11. CMOs with Conjugation Capabilities

20.12. Antibody Drug Conjugate One-Stop-Shops

20.13. Increasing Demand for One-Stop-Shops

- CASE STUDY 2: COMPANION DIAGNOSTICS FOR ANTIBODY DRUG CONJUGATES THERAPEUTICS

21.1. Chapter Overview

21.2. Companion Diagnostics for Antibody Drug Conjugates

21.3. Companion Diagnostics For Antibody Therapeutics

21.4. Most Prominent Players: Analysis by Number of Tests

- SWOT ANALYSIS

22.1. Chapter Overview

22.2. Strengths

22.3. Weaknesses

22.4. Opportunities

22.5. Threats

- MARKET FORECAST AND OPPORTUNITY ANALYSIS

23.1. Chapter Overview

23.2. Forecast Methodology and Key Assumptions

23.3. Global Antibody Drug Conjugates Market, 2023-2035

23.4. Antibody Drug Conjugates Market: Product-wise Sales Forecast, 2023-2035

- EXECUTIVE INSIGHTS

24.1. Chapter Overview

24.2. Oxford Biotherapeutics

24.3. Angiex

24.4. Syndivia

24.5. BSP Pharmaceuticals

24.6. PolyTherics (an Abzena company)

24.7. CureMeta

24.8. CytomX Therapeutics

24.9. NBE-Therapeutics

24.10. Cerbios-Pharma

24.11. Eisai

24.12. AbTis

24.13. AmbrX

24.14. Synaffix

24.15. Pierre Fabre

24.16. Catalent Pharma Solutions

24.17. Lonza

24.18. Piramal Healthcare

24.19. Ajinomoto Bio-Pharma Services

24.20. Cardiff University

24.21. Anonymous, Director, Business Development, Leading CMO

24.22. Anonymous, Chief Executive Officer, Leading CMO

- CONCLUSION

- APPENDIX 1: TABULATED DATA

- APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

To view more details on this report, click on the link:

https://www.rootsanalysis.com/reports/view_document/antibody-drug-conjugates-market/270.html

Learn from experts: do you know about these emerging industry trends?

Novel Cell Cytometers: Need of the Hour

Patient Recruitment – Key Determinant of Successful Clinical Trials

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Learn more about Roots Analysis consulting services:

Roots Analysis Consulting - the preferred research partner for global firms

Contact:

Ben Johnson

+1 (415) 800 3415